10 Apr | Written by Hailey Ng

Despite growing global concerns over climate change and the urgent need for energy transition, the oil and gas industry has seen a significant surge in Merger and Acquisition (M&A) activity. In the final quarter of 2023 alone, the sector witnessed deals exceeding $155 billion, as reported by Bloomberg.

A standout among these was ExxonMobil’s acquisition of Pioneer Natural Resources, an all-stock deal valued at $64.5 billion, announced on October 23, 2023. This transaction, however, raises important questions regarding its impact on the environment.

The Acquisition at a Glance

Pioneer stands as one of the top oil and gas producers in the Permian Basin, which is not only the most critical oil-producing region in the U.S. but also the world’s most significant basin outside of OPEC.

Through its acquisition of Pioneer, ExxonMobil becomes the dominant producer in the Permian and also gains the flexibility to adjust production to meet short-term demands — an ability that will be increasingly crucial during the energy transition.

ExxonMobil’s decision to move forward with the acquisition, despite high borrowing costs, appears to be motivated by the rise in oil prices, which recently hit around $86 per barrel. ExxonMobil seems to be betting on the continued rise of oil prices, influenced by factors like Saudi Arabia reducing its oil exports and ongoing geopolitical tensions in the Middle East that could disrupt global oil supplies and push prices even higher. These factors suggest that ExxonMobil is strategically counting on the advantages of higher oil prices to outweigh the high costs associated with funding this acquisition.

But What About Carbon Reduction?

Pioneer, despite its prominence in the Permian Basin, lacked the operational scale, financial resources, and technological access that ExxonMobil can provide. While Darren Woods, the CEO of ExxonMobil, has claimed that the combined efforts of Pioneer and ExxonMobil will result in increased production efficiencies that are cost-effective and purportedly more environmentally friendly, these claims warrant a closer examination in the context of its environmental impact.

Increased Production vs. Environmental Sustainability

Post-acquisition, production from the combined operations of the energy giants in the Permian Basin is set to more than double, reaching 1.3 million barrels of oil equivalent per day (MMBoE/D) and potentially escalating to 2 MMBoE/D by 2027.

While these efficiency improvements per unit of production can theoretically reduce emissions, the significant increase in overall production could potentially offset these environmental benefits. Therefore, achieving a net positive environmental impact would necessitate potential investments in carbon capture and storage (CCS), renewable energy, and other emission-reducing measures to counterbalance the rise in total emissions.

Controlled Supply Growth

In evaluating whether the ExxonMobil/Pioneer acquisition is beneficial or detrimental for climate change, Neil Quach, Senior Corporate Research Analyst at Carbon Tracker, suggests that acquiring existing reserves from other companies can be slightly more beneficial for the climate than investing in new reserves. Quach points out that this approach does not add to new supply and can lead to more controlled supply growth.

In the context of oil and gas, “new supply” typically refers to the development of previously untapped or undeveloped reserves. Therefore, when a company like ExxonMobil purchases Pioneer’s existing operations, it is essentially integrating current production capacities without adding new extraction fronts, which can lead to more sustainable management of resources and mitigate the environmental impacts associated with new explorations. This method, according to Quach, leads to a more controlled and predictable growth in supply, aligning slightly better with climate change mitigation efforts compared to expanding into new territories.

Regulatory Oversight and Compliance

Moreover, large corporations like ExxonMobil are often subject to more intense regulatory oversight and public scrutiny than smaller companies. This heightened attention can lead to better compliance with environmental laws and regulations, and potentially more investment in technologies that reduce the environmental impact of their operations.

Pioneer’s Net-Zero Ambitions

ExxonMobil expressed its plans to accelerate Pioneer’s net-zero goal for Scope 1 & 2 carbon emissions in the Permian Basin from 2050 to 2035, demonstrating a commitment to reducing operational emissions. However, the effectiveness of these targets in contributing to global climate goals depends on the scope of emissions covered and the strategies employed to achieve reductions. The focus remains on Scope 1 & 2 emissions, often leaving out Scope 3, which includes emissions from the consumption of their products.

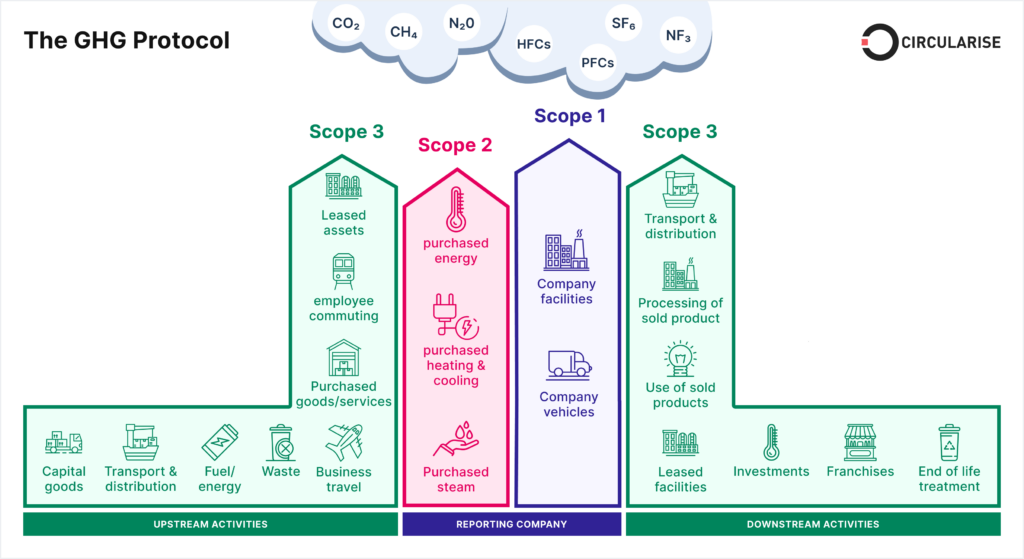

Scope 1, 2, and 3 emissions are categories defined by the Greenhouse Gas (GHG) Protocol that distinguish between the different sources of emissions generated from a company’s operations:

- Scope 1 emissions are direct emissions from sources that are owned or controlled by the company, e.g. emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc.

- Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.

- Scope 3 emissions are all other indirect emissions that occur in a company’s value chain, including both upstream (exploring and producing oil and natural gas) and downstream (refining and processing oil and natural gas) emissions.

Focusing on Scope 1 and 2 emissions allows ExxonMobil to control and reduce its direct operational footprint. However, for the acquisition to have a broader impact on global emissions and climate change, ExxonMobil would need to address Scope 3 emissions, which encompass the emissions from the end-use of their products. This is crucial since these emissions are often the largest portion of emissions for most oil and gas companies.

Conclusion

While the acquisition of Pioneer Natural Resources by ExxonMobil is viewed as a strategically advantageous move — likely to delight shareholders and strengthen ExxonMobil’s foothold in the Permian Basin — the wider implications for climate change cannot be overlooked. The ultimate environmental impact of this acquisition hinges on several critical factors: how ExxonMobil integrates Pioneer’s assets into its overarching business strategy, the firm’s genuine commitment to sustainability and achieving its climate goals, and the pace at which the global energy sector shifts towards renewable sources. Ideally, ExxonMobil will leverage Pioneer’s existing infrastructure to enhance operational efficiencies and significantly reduce overall carbon emissions, rather than simply boosting oil output. If managed thoughtfully, this acquisition could serve not just the financial interests of ExxonMobil’s stakeholders, but also advance the broader goal of transitioning to a more sustainable energy landscape.

Leave a Reply