24 Jul | Written By Hailey Ng

Asset Management, Private Equity, Hedge Funds — these terms get tossed around frequently, but for the longest time, their differences felt murky to me. By breaking down these concepts in a way that makes sense to me, I hope to not only clarify my own understanding but also help anyone else who’s felt a bit lost in the jargon. If these terms have ever left you scratching your head, I hope this post makes them clearer.

Asset Management

What is Asset Management?

Think of asset management like having a personal coach for your money. Instead of just keeping your savings safe, an asset manager works to grow it. They create plans to help individuals and institutions (like pension funds or insurance companies) manage, upgrade, or dispose of their assets in a cost-effective way. Asset managers offer a range of investment options, from traditional ones like stocks and bonds to alternative investments that aren’t typically available to the average investor. The main goal is to grow the client’s assets while minimising risk. To achieve this, asset managers conduct thorough research and invest in various products such as equities, fixed income (bonds), real estate, commodities, and mutual funds.

How Does It Work?

- Diversification: To balance risk, asset managers invest in different types of assets. This way, if one investment loses value, another might gain, keeping the portfolio stable overall.

- Long-Term Focus: Asset managers usually aim for steady growth over time, making sure their clients’ wealth is secure in the future — pension funds are a perfect example of this.

- Active vs. Passive Management: Some managers actively pick investments (active management), while others might just track an index like the S&P 500 (passive management).

Key Players:

- BlackRock (The world’s largest asset manager)

- Vanguard

- Fidelity Investments

- State Street Global Advisors

Private Equity (PE)

What is Private Equity (PE)?

Private equity firms are like business doctors. They buy companies (often struggling or undervalued), fix them up over 3-5 years by cutting costs, improving operations, and then sell them for a profit — either to another investor or by taking the company public again.

PE firms typically buy stakes in private companies or take public companies private. They raise capital from their own money, wealthy individuals and institutions, pooling funds into PE funds to fuel their acquisitions.

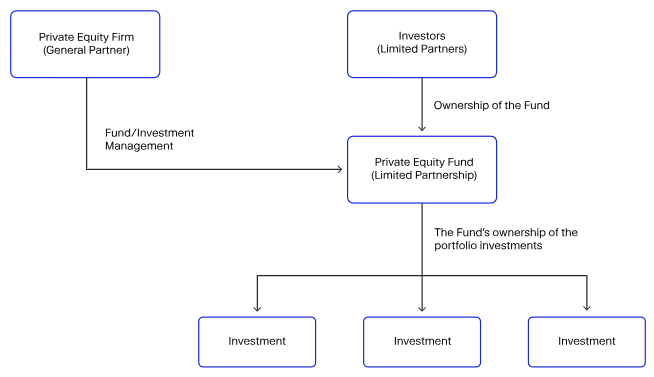

General Partners (GPs) and Limited Partners (LPs)

In private equity, there are two main types of players:

- General Partners (GPs)

These are the PE firms themselves, responsible for managing the fund, selecting companies to invest in, and executing the strategy (like cutting costs, restructuring, or merging companies). They invest a small portion of their own money but primarily manage the investments on behalf of others. - Limited Partners (LPs)

These are the investors — such as pension funds, endowments, and wealthy individuals — who provide the majority of the capital for the PE fund. LPs contribute money to the fund but leave the management to the GPs. Their involvement is “limited,” as they don’t participate in day-to-day decision-making but expect to receive a share of the profits when the investment is sold.

How Does It Work?

- Leveraged Buyouts (LBOs): PE firms typically use a mix of their own money and borrowed funds (debt) to buy companies. This leverage magnifies potential returns but also adds risk. The goal is for the company’s profits to help pay off the debt over time.

- Value Creation: Once a PE firm acquires a company, the real work begins. They aim to make the business more profitable by restructuring operations, cutting costs, or even merging it with another company. They may also bring in new management or invest in growth to increase the company’s value.

- Exit Strategy: After 3-5 years, once the company is in better shape, the PE firm looks to sell it — either to another company, another PE firm, or through an Initial Public Offering (IPO). The goal is to sell it at a much higher price than they paid, generating profits for both the GPs and the LPs.

Key Players:

- The Blackstone Group

- KKR (Kohlberg Kravis Roberts & Co.)

- Carlyle Group

- TPG Capital

Private Credit

What is Private Credit?

Private credit refers to loans that aren’t provided by traditional banks but by private funds or investment firms. Private credit is growing because it offers companies more tailored financing options compared to traditional banks, either because they need more flexible terms or because they’re taking on more risk.

How Does It Work?

Private credit funds raise money from institutional investors, like pension funds or insurance companies, and then lend it out to businesses. Here’s the typical process:

- Direct Lending: This is when private credit funds provide loans directly to companies, often mid-sized ones, without going through a bank. These loans can be used for anything from expansion to restructuring.

- Mezzanine Financing: A hybrid of debt and equity financing, often used in acquisitions. It’s riskier than regular loans because, in case the company fails and has to sell its assets (i.e. liquidation), mezzanine lenders are paid after more senior lenders (like banks). So, they take on more risk but get higher returns if things go well.

- Distressed Debt: Some private credit funds buy the debt of companies in financial trouble at a discount. The goal is either to profit from the company’s recovery or to gain control of the company by restructuring its finances.

Key Players:

- Oaktree Capital Management: A leader in distressed debt and private credit, specialising in distressed debt.

- Ares Management: One of the largest alternative asset managers with a significant focus on private credit.

- Apollo Global Management: While known for private equity, Apollo is also a significant player in private credit.

- KKR Credit: The credit arm of KKR, which provides a range of private credit solutions.

Hedge Funds

What is a Hedge Fund?

Hedge funds are the thrill-seekers of the finance world. They’re investment funds that aim for high returns, often using strategies that involve more risk than traditional investments. Unlike asset management, hedge funds don’t just play the long game — they’re in it for the big wins (and sometimes big losses).

Hedge funds are less regulated than other investment vehicles, making them more flexible but also more exclusive —they’re usually only available to accredited investors. Hedge funds are often set up as private limited partnerships and are designed to take advantage of specific market opportunities. Essentially, they aim to outperform the market or provide a “hedge” against unexpected market changes, like economic downturns or geopolitical events.

How Does It Work?

Hedge funds can invest in almost anything — stocks, bonds, commodities, currencies, or even more exotic assets like derivatives. Here’s how they typically operate:

- Long/Short Strategies: Hedge funds might buy stocks they think will rise in value (long positions) and sell stocks they think will drop in value (short positions). This allows them to potentially make money whether the market goes up or down.

- Leverage: Similar to PE, hedge funds often use borrowed money to amplify their bets. This can lead to higher returns, but also higher risks.

- Event-Driven Strategies: Some hedge funds invest based on specific events, like mergers, bankruptcies, or corporate restructurings. They try to predict the outcome and profit from it.

Key Players:

- Bridgewater Associates

- Renaissance Technologies

- Citadel

- Two Sigma

So, How Do They Compare?

Let’s wrap this up with a quick comparison:

- Asset Management is about growing wealth steadily over time, using a balanced mix of investments. It’s the most traditional and conservative of the three.

- Private Equity is all about buying, fixing, and selling businesses. It’s hands-on and focuses on transforming companies to increase their value.

- Private Credit is the alternative lender, filling the gap left by traditional banks, often providing the financing that enables private equity deals or that hedge funds use in their strategies.

- Hedge Funds are the high-risk, high-reward players, using a variety of strategies to try and outperform the market.

| Aspect | Asset Management | Private Equity (PE) | Hedge Funds | Private Credit |

| Objective | Grow and preserve wealth over the long term | Buy, improve, and sell companies for a profit | Achieve high returns through various strategies | Provide alternative lending solutions |

| Investment Style | Typically diversified across various assets | Focused on acquiring and transforming companies | Use a wide range of strategies, often involving high risk | Direct lending, mezzanine financing, and distressed debt |

| Risk Level | Generally lower, with a focus on steady returns | Higher risk due to leverage and focus on turnarounds | Higher risk, with strategies that can be highly speculative | Moderate to high risk, depending on the credit quality of borrowers |

| Liquidity | High liquidity; investors can usually redeem funds easily | Low liquidity; investments are long-term and locked up | Low to medium liquidity; some strategies are more liquid than others | Low liquidity; loans are typically long-term and illiquid |

| Investment Horizon | Long-term (years to decades) | Medium to long-term (3-7 years) | Short to medium-term (can vary widely) | Medium to long-term |

| Sources of Capital | Pooled funds from individuals and institutions | Funds raised from institutional investors (LPs) | Pooled funds from high-net-worth individuals and institutions | Funds raised from institutional investors |

| Regulation | Highly regulated, especially for retail investors | Regulated, with less public disclosure than asset managers | Less regulated, allowing for more flexibility in strategies | Moderately regulated, with emphasis on protecting investor capital |

| Return Profile | Steady, often benchmarked to indices | High returns targeted, but with higher risk | High returns, often uncorrelated with market movements | Moderate returns with a focus on income generation |

| Examples of Key Players | • BlackRock • Vanguard • Fidelity | • Blackstone • KKR • Carlyle | • Bridgewater • Renaissance • Citadel | • Oaktree • Ares • Apollo |

I hope this post has helped clarify some of the confusion around these financial terms and given you a clearer understanding of Asset Management, Private Equity, Private Credit, and Hedge Funds. Stay tuned for Episode 2, where I’ll be breaking down the world of Mergers & Acquisitions (M&A) and uncovering the strategies behind these major corporate moves!

Leave a Reply